Dec 13, 2023 · PayPal Bill Pay provides a way to pay utilities, property taxes, and more without credit card fees. Learn more with this step-by-step guide.

https://katiestraveltricks.com/paypal-bill-pay/

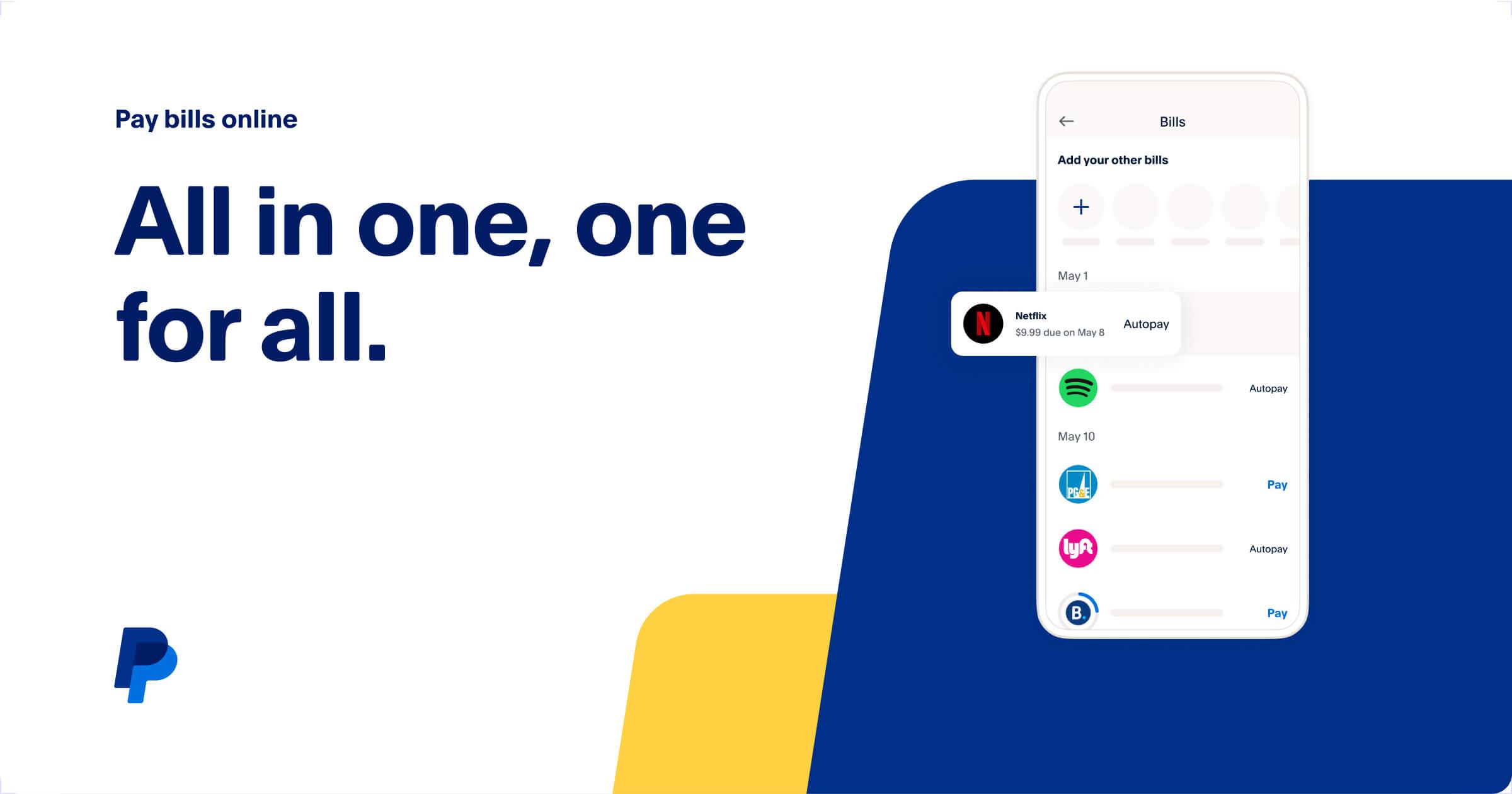

Pay Your Property Taxes with Ease Using PayPal Bill Pay

Are you tired of the hassle of writing checks or visiting your local tax office to pay your property taxes? With PayPal Bill Pay, you can now pay your property taxes online, quickly and securely. Here’s how:

Step 1: Visit PayPal Bill Pay

Go to https://www.paypal.com/us/digital-wallet/manage-money/pay-bills to access PayPal Bill Pay.

Step 2: Add Your Property Tax Biller

Click on “Add a New Bill” and search for your property tax biller. Enter your account number and confirm your account details.

Step 3: Enter Your Payment Amount

Check your property tax statement to determine the amount due. Enter the payment amount in the PayPal Bill Pay form.

Step 4: Choose Your Payment Method

Select the credit card or bank account you want to use to make the payment. PayPal Bill Pay allows you to pay your property taxes with a credit card without incurring any additional fees.

Step 5: Submit Your Payment

Review the payment details and click “Pay” to submit your payment. PayPal Bill Pay will process your payment and send it to your property tax biller.

Benefits of Using PayPal Bill Pay:

- Convenience: Pay your property taxes online from anywhere, anytime.

- No Fees: Avoid additional fees associated with credit card payments.

- Security: PayPal’s secure platform protects your financial information.

- Payment Tracking: Track your payment status and view your payment history online.

- Earn Rewards: Earn points or miles on your credit card when you pay your property taxes through PayPal Bill Pay.

Additional Tips:

- Check Your Statement: Ensure that the payment amount matches the amount due on your property tax statement.

- Pay Early: Submit your payment at least a week before the due date to avoid late fees.

- Monitor Your Accounts: Track your bank and property tax accounts to ensure that the payment has been processed successfully.

Conclusion:

PayPal Bill Pay is a convenient, secure, and fee-free way to pay your property taxes online. By following these steps, you can simplify your tax payment process and enjoy the benefits of using PayPal’s trusted platform.

FAQ

Can I use PayPal Credit to pay property taxes?

n

Can I pay utilities with PayPal?

n

Does PayPal work with the government?

n

How do I pay my Alameda County property tax with PayPal?

n

Read More :

https://www.paypal.com/us/digital-wallet/manage-money/pay-bills