If the payment isn’t credited after two days, please start by calling the company’s customer service line to check on your payment. If the problem isn’t

Bill Pay Check Not Received: A Comprehensive Guide to Resolving Payment Issues

Introduction

Paying bills on time is crucial for maintaining a healthy financial standing. However, sometimes, payments may not reach their intended recipients on time, causing confusion and stress. If you’re facing this situation, don’t panic. This comprehensive guide will provide you with step-by-step instructions on what to do when a bill pay check is not received.

Common Reasons for Payment Delays

- Company processing delays: Some companies may take several days to process payments, especially if they receive a high volume of payments.

- Bank errors: Occasionally, banks may experience technical issues or human errors that can delay the delivery of payments.

- Incorrect payee information: If the payee’s name, address, or account number is incorrect, the payment may not be delivered successfully.

- Insufficient funds: If your checking account does not have sufficient funds to cover the payment, the bank will return the check or electronic payment.

Steps to Take When a Check Is Not Received

1. Contact the Payee:

- Call or email the company you sent the payment to and inquire about the status of your payment.

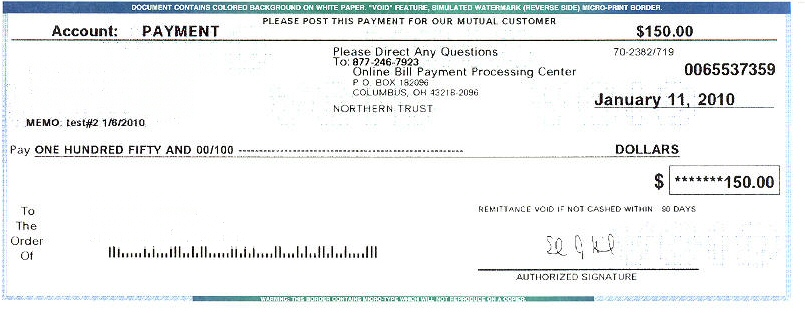

- Provide them with the check number, payment amount, and date sent.

- Ask if they have received the payment or if there are any issues with the payee information.

2. Contact Your Bank:

- If the payee confirms that they have not received the payment, contact your bank and report the missing check.

- Provide them with the same information you gave to the payee.

- The bank will investigate the issue and determine if there was an error on their end.

3. Submit a Payment Inquiry:

- If the bank cannot resolve the issue, you can submit a payment inquiry through your online banking platform or by calling your bank’s customer service line.

- Provide the bank with all relevant information about the payment, including the payee’s name, payment amount, and date sent.

- The bank will contact the payee on your behalf and request assistance in locating the payment.

4. Stop Payment:

- If you believe the check was lost or stolen, you can request a stop payment order from your bank.

- This will prevent the check from being cashed if it falls into the wrong hands.

- Note that there may be a fee for this service.

5. File a Dispute:

- If all other options fail, you can file a dispute with your bank.

- Provide them with documentation of your payment and any correspondence you have had with the payee and your bank.

- The bank will investigate the dispute and determine if you are entitled to a refund.

Tips for Preventing Payment Delays

- Set up automatic bill pay: This ensures that your bills are paid on time, even if you forget or are out of town.

- Use online bill pay: This is a convenient and secure way to pay bills electronically, reducing the risk of delays or lost checks.

- Confirm payee information: Always double-check the payee’s name, address, and account number before sending a payment.

- Maintain sufficient funds: Make sure your checking account has enough funds to cover all scheduled payments.

- Monitor your bank statements: Regularly review your bank statements to ensure that all payments have been processed correctly.

Conclusion

If you encounter a situation where a bill pay check is not received, it’s important to act promptly to resolve the issue. By following the steps outlined in this guide, you can increase the chances of recovering your payment and ensuring that your bills are paid on time. Remember, communication and documentation are key to successfully resolving payment issues.

FAQ

How long does it take to receive a check from bill pay?

n

What happens if you lose a bill pay check?

n

What if a bill pay check is never cashed?

n

Are bill pay checks guaranteed?

n

Read More :

https://www.bogleheads.org/forum/viewtopic.php%3Ft%3D80789