Rating 4.9 (8) Oct 29, 2023 · Paying your bills on time or before the due date will help you avoid problems. Use these bill pay checklists to keep everything organized.When to Use a Bill Tracker · What to Include in a Bill

https://templatelab.com/bill-pay-checklists/

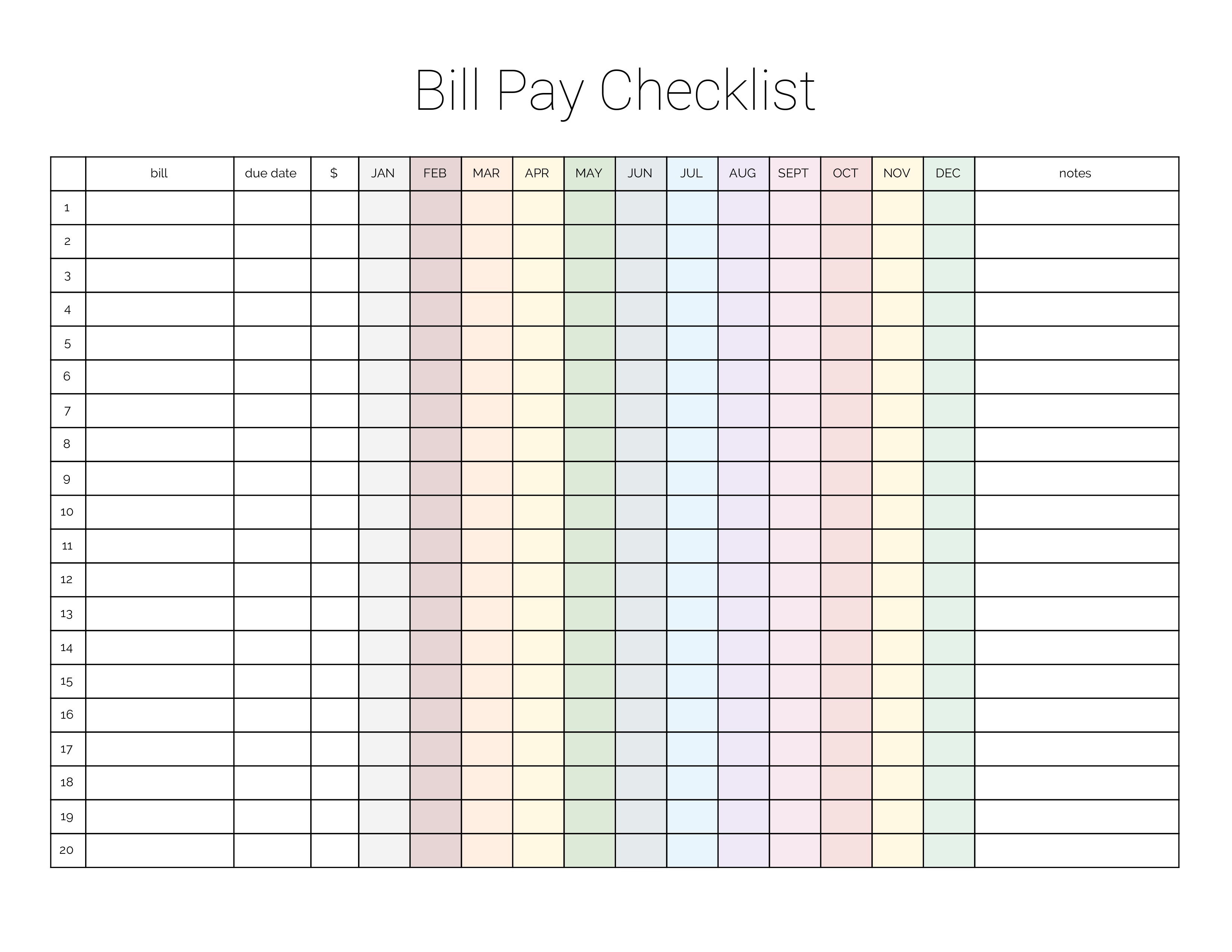

Simplify Bill Management with a Bill Pay Calendar Template

Are you tired of juggling multiple bills and missing due dates? A bill pay calendar template can be your saving grace, helping you stay organized and avoid late fees. In this comprehensive guide, we’ll walk you through the benefits of using a bill pay calendar and provide you with a free template to get started.

Benefits of Using a Bill Pay Calendar

- Stay organized: Keep track of all your bills in one place, ensuring you never miss a payment.

- Avoid late fees: Mark due dates clearly to prevent costly penalties.

- Plan your budget: See when bills are coming up and adjust your budget accordingly.

- Reduce stress: Eliminate the anxiety of forgetting to pay bills and improve your financial well-being.

- Improve your credit score: Timely bill payments contribute to a positive credit history.

How to Use a Bill Pay Calendar

- Gather your bills: Collect all your monthly bills and receipts.

- Note due dates: Mark the due date for each bill on your calendar.

- Set reminders: Schedule reminders a few days before the due date to ensure you have enough time to make the payment.

- Track payments: Mark bills as paid once you’ve made the payment.

- Review regularly: Check your calendar regularly to stay on top of upcoming bills.

Free Bill Pay Calendar Template

To get started, download our free bill pay calendar template:

This template includes:

- A monthly calendar view

- Space to note bill names, due dates, and amounts

- A section for tracking payments

- A reminder section for upcoming bills

Additional Tips for Bill Management

- Use online banking: Set up automatic payments or reminders through your bank’s online portal.

- Explore bill payment apps: Utilize apps like Mint or Venmo to manage bills, track expenses, and set reminders.

- Consider a bill consolidation service: If you have multiple bills with different due dates, consider consolidating them into one payment.

- Negotiate with creditors: If you’re struggling to make payments, contact your creditors to discuss payment arrangements or hardship programs.

- Seek professional help: If you’re overwhelmed with bill management, consider consulting a financial advisor or credit counselor.

Conclusion

Using a bill pay calendar template is an effective way to streamline your finances and avoid the consequences of late payments. By staying organized and planning ahead, you can reduce stress, improve your credit score, and gain control of your financial well-being. Download our free template today and start simplifying your bill management!

Read More :

https://files.consumerfinance.gov/f/documents/cfpb_ymyg_disabilities_bill-calendar.pdf