20 Free Bill Pay Checklists & Bill Calendars (PDF, Word & Excel). Paying your bills on time or before the due date will help you avoid problems. Use these bill

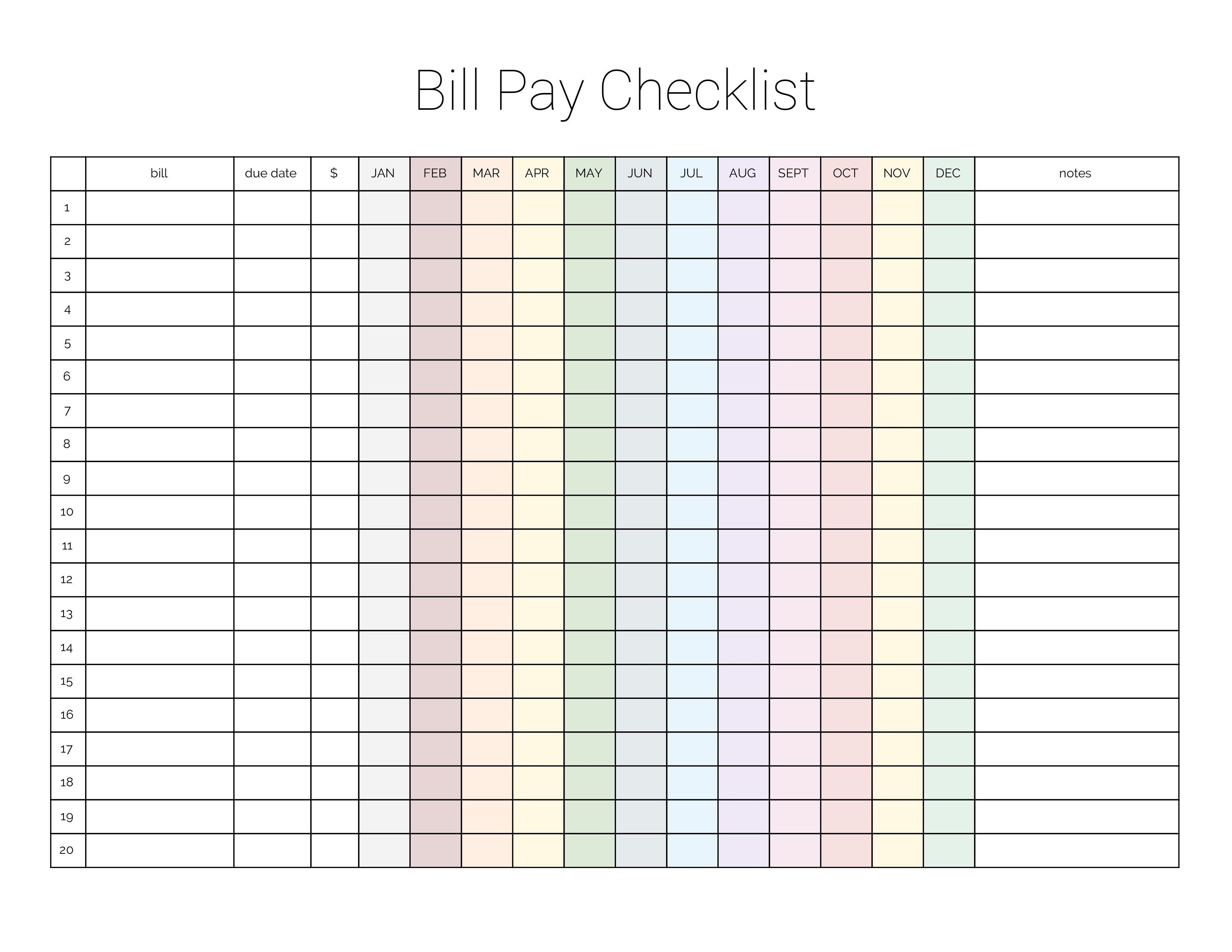

Conquer Bill Management with Our Free Printable Bill Pay Checklist

Are you tired of the hassle and stress of managing your bills? Say goodbye to late payments and financial worries with our comprehensive bill pay checklist, available for free download!

Click here to download your free printable bill pay checklist now:

What is a Bill Pay Checklist?

A bill pay checklist is an essential tool that helps you keep track of all your bills, ensuring that you pay them on time and avoid late fees and penalties. It’s like a personal financial assistant that keeps you organized and in control of your expenses.

Benefits of Using a Bill Pay Checklist

- Stay organized: Keep all your bills in one place, eliminating the risk of missing or losing them.

- Avoid late payments: Track due dates and set reminders to ensure timely payments.

- Save money: Avoid late fees and penalties by staying on top of your bills.

- Reduce stress: Eliminate the anxiety and worry associated with managing bills.

- Improve financial health: By staying organized and paying bills on time, you can improve your credit score and financial well-being.

How to Use Your Bill Pay Checklist

- Gather your bills: Collect all your bills, including utilities, credit cards, loans, and subscriptions.

- Fill in the information: Enter the bill’s name, due date, payment amount, and any additional notes in the designated fields.

- Set payment reminders: Use the checklist to set reminders for yourself to pay bills before their due dates.

- Mark payments as paid: Once you’ve made a payment, mark it as paid on the checklist to avoid double payments.

- Review regularly: Regularly review your checklist to ensure that all bills are accounted for and paid on time.

Additional Tips for Effective Bill Management

- Set up automatic payments: Consider setting up automatic payments for recurring bills to avoid missed due dates.

- Use a budgeting app: Track your expenses and create a budget to stay within your means and avoid overspending.

- Negotiate with creditors: If you’re struggling to pay a bill, reach out to your creditors to discuss payment plans or reduced interest rates.

- Seek professional help: If you’re overwhelmed with debt or struggling to manage your finances, consider seeking professional help from a financial advisor or credit counselor.

Conclusion

Managing bills doesn’t have to be a chore. With our free printable bill pay checklist, you can take control of your finances, avoid late payments, and improve your financial well-being. Download your checklist today and start simplifying your bill management process!

Read More :

https://www.smartsheet.com/sites/default/files/2020-11/IC-Printable-Bill-Pay-Checklist-8966-PDF.pdf