Aug 23, 2021 · Yes, Chase withdraws the money on the date the check is issued.LL said they didn’t receive my May rent check. It was sent via Chase bill pay on 4/13 (and Chase Bill Pay switched from 1 day electronic to 5 day paper check? : r/CreditCardsChase’ Bill Pay Functionality QuestionMore results from www.reddit.com

What Happens to a Chase Bill Pay Check That’s Not Cashed?

If you’ve ever sent an electronic bill payment and then forgotten about it, you may be wondering what happens if the payee doesn’t cash the check. The good news is that the check will eventually expire and the funds will be returned to your account.

Here’s what happens to a Chase bill pay check that’s not cashed:

- The check will expire after 90 days. This is the standard expiration date for all checks, regardless of the issuer.

- The funds will be returned to your account. Once the check expires, the funds will be automatically returned to your checking account.

- You will receive a notification from Chase. Chase will send you a notification when the check expires and the funds are returned to your account.

What if the payee cashes the check after it expires?

If the payee cashes the check after it expires, the bank may charge a fee. The fee will vary depending on the bank, but it is typically around $25.

How to avoid having a bill pay check expire

The best way to avoid having a bill pay check expire is to keep track of your payments. You can do this by setting up a reminder system or by using a bill pay service.

If you have any questions about Chase bill pay, you can contact customer service at 1-800-935-9935.

Here are some additional resources that you may find helpful:

FAQ

What happens if bill pay check is never cashed?

n

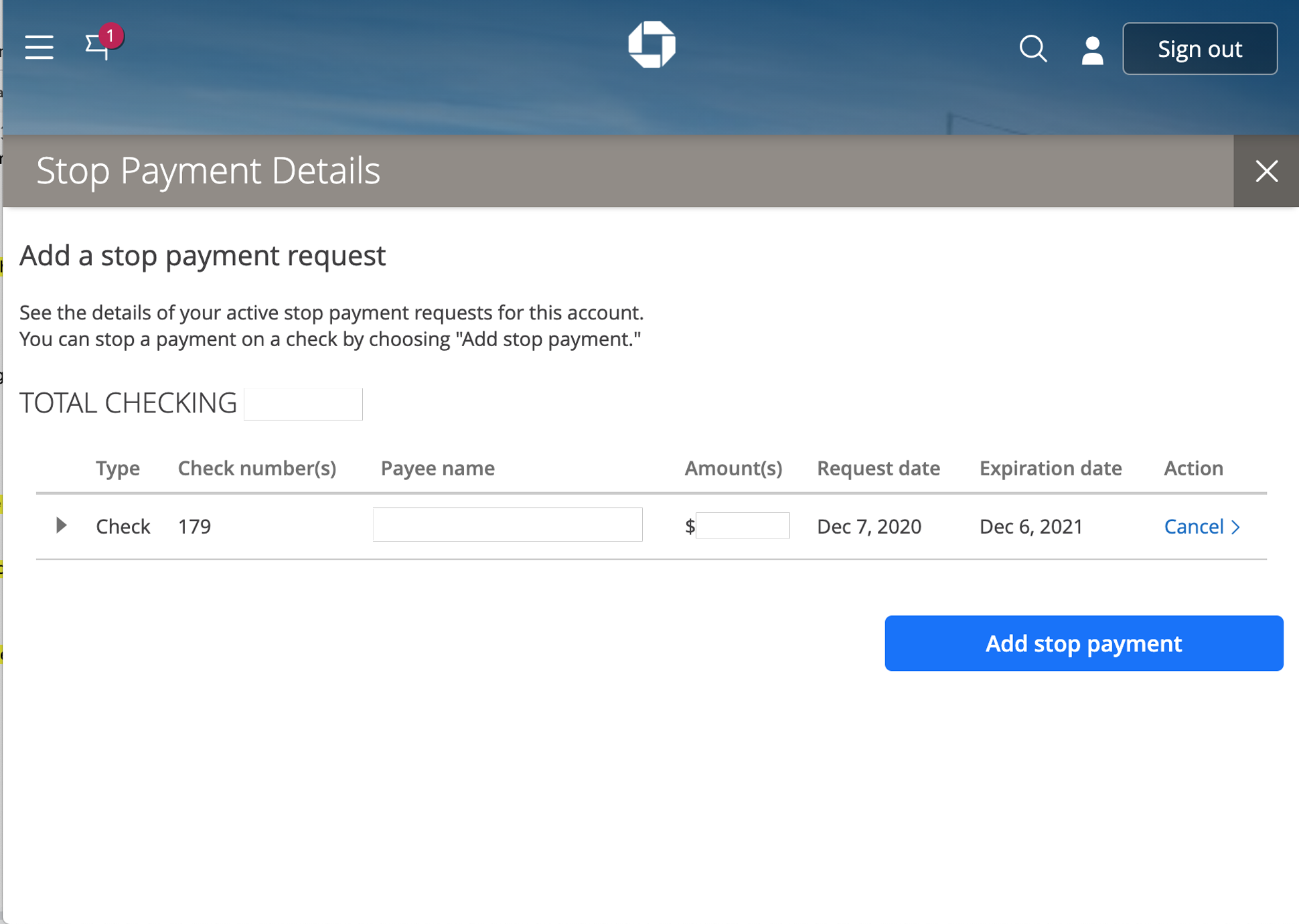

Can you cancel a Billpay check?

n

What happens if you lose a bill pay check?

n

How long are bill pay checks good for?

n

Read More :

https://www.quora.com/What-happens-to-an-electronic-bill-pay-check-that-doesnt-get-cashed-by-the-payee